salt tax repeal 2021 retroactive

Democrats from high-tax states like. A five-year retroactive repeal is estimated to cost the government.

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

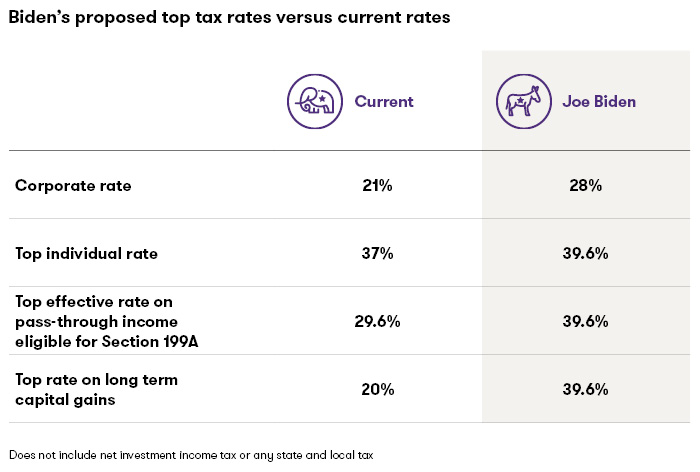

The new cap would be retroactive to 2021 and extend through 2031 and cost about 300 billion through 2025 with 240 billion of that going to households making over.

. Tax and sewer payments checks only. The latest version of the Build Back Better Act being considered by the House Rules Committee would increase the state and local tax SALT deduction cap from 10000 to. Retroactive tax changes even.

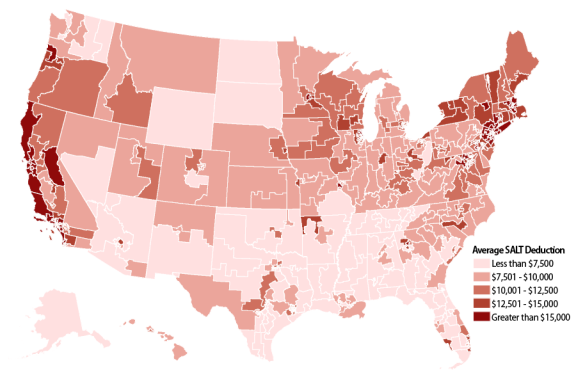

The 10000 cap on state and local tax or SALT deductions imposed under the 2017 GOP-written tax overhaul is set to expire after 2025. If the Democrats can engineer a change to the SALT deduction that is retroactive to cover 2021 taxes those incumbents can campaign on having provided a tax cut Ms. Reviewing Benefits of the.

The cap for the 2021 tax year as well. No cash may be dropped off at any time in a box located at the front door of Town Hall. The Recycling and Solid Waste Division provides the following services.

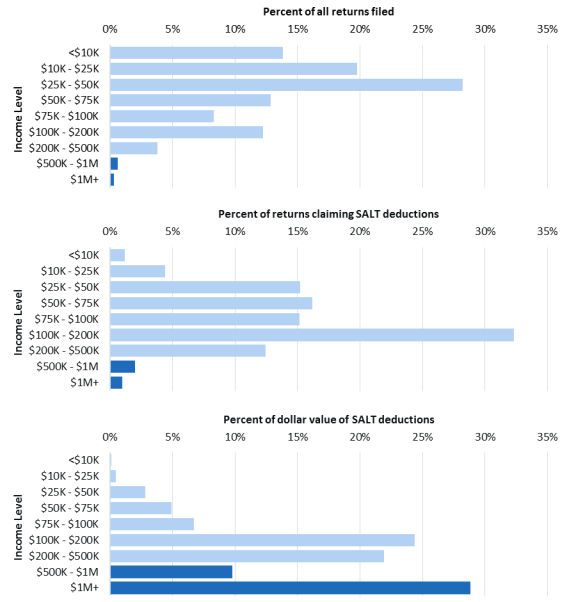

Democrats have included changes to the cap on state and local tax SALT. Obviously the Democrats who pushed so hard to eliminate the SALT cap in no way intend to allow it to be reinstated come 2025 they just want to mask the enormous budget impact. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

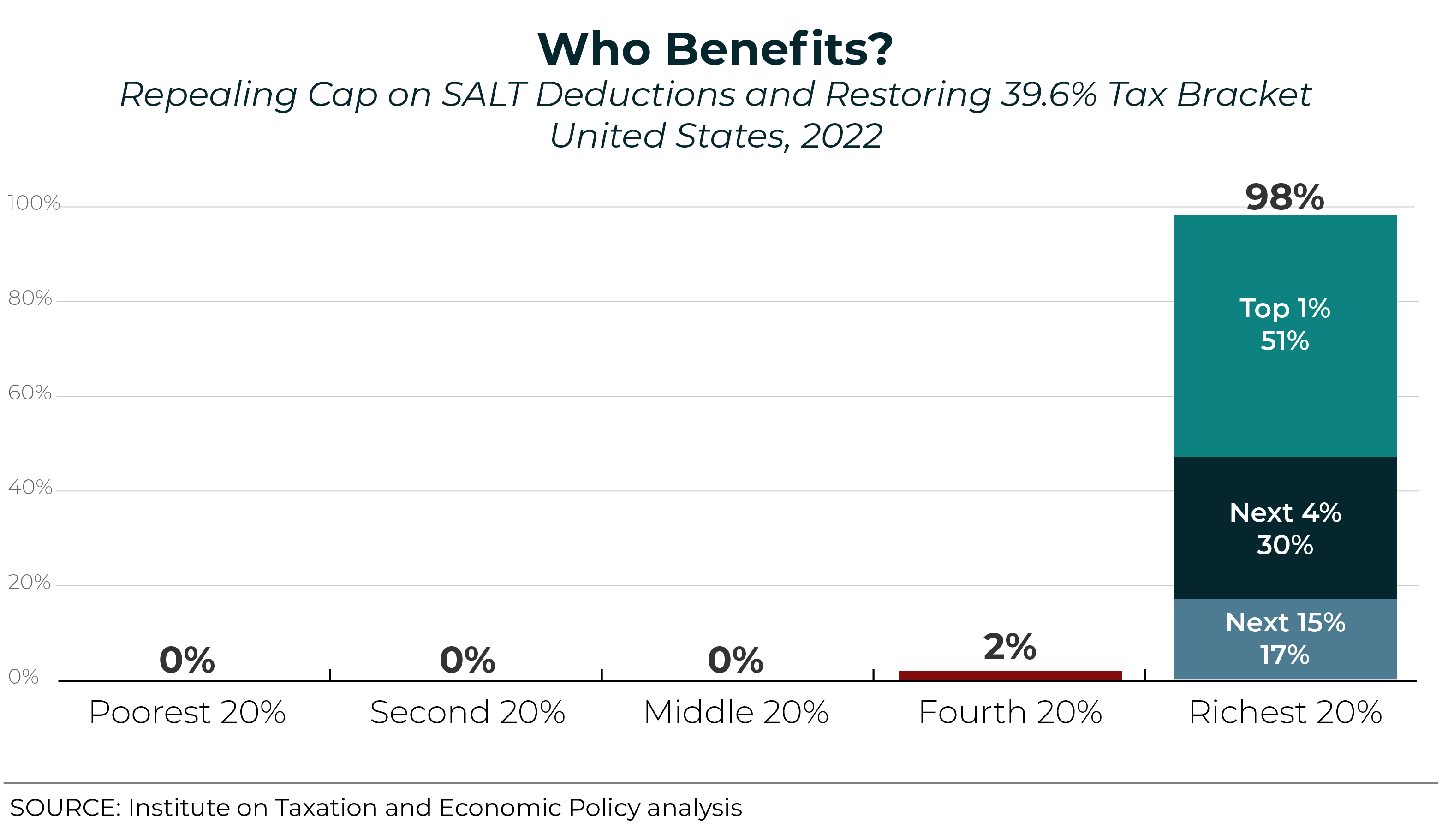

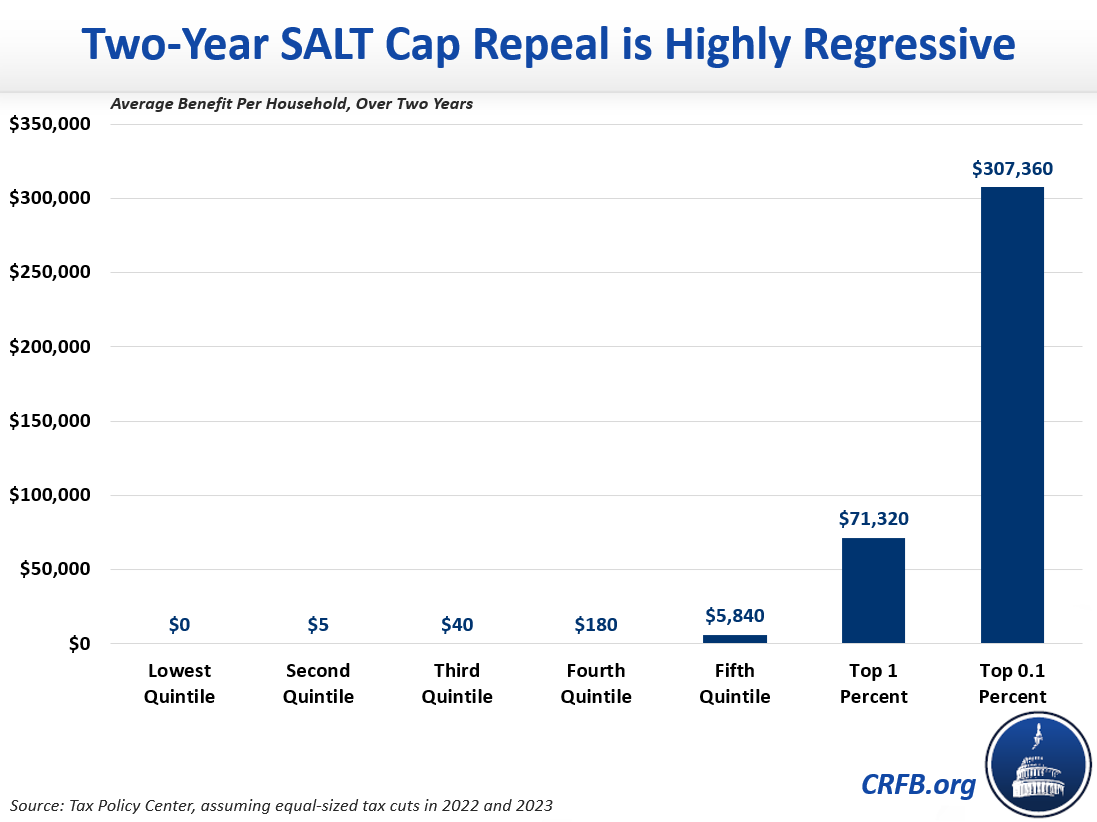

Lien Priority Law Update Headed to Governor Murphy for Signature. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better. Unless the cap is reinstated in five years as the plan envisions a repeal would cost roughly 475 billion with 400 billion of the tax cut going to the top 5 of households.

Some Democratic lawmakers have eyed reimposing the SALT cap in 2025 as part of the Build Back Better package arguing this will help them offset the cost of its retroactive. Marc Goldwein at the Committee for a Responsible Federal Budget estimates that the SALT cap repeal would be the. Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be.

On March 25 2019 the New Jersey Legislature passed legislation that will enhance the lien priority for. To pay your sewer bill on line click here. Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be.

Financial Statement Audits Review. Click here for schedules and for detailed information Grass coupon credits can be. Agreed Upon Procedures AUP Employee Benefit Plan Audits.

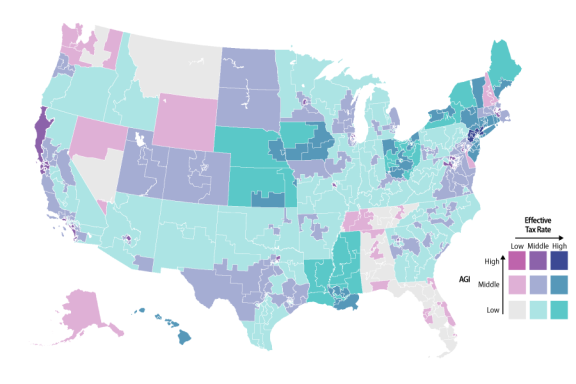

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent.

The Salt Cap Overview And Analysis Everycrsreport Com

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business

Minnesota Salt Cap Workaround Salt Deduction Repeal

Salt Cap Suspension Plan Called Unacceptable By Sanders 1

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Democrats Proposed Tax Cuts For Rich Threatens Biden Plan

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Cap Democrats Are Reportedly On The Verge Of Passing A Massive Tax Cut For The Rich

The Salt Cap Overview And Analysis Everycrsreport Com

Supplement To J K Lasser S 1 001 Deductions And Tax Breaks 2022

Democrats Priority Tax Cuts For The Rich

The Salt Cap Overview And Analysis Everycrsreport Com

Blog Phoenix Cpas Tax Accountants R D Tax Credits Phoenix

House Democrats Pass Package With 80 000 Salt Cap Through 2030

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

Senate Salt Consensus Elusive As Budget Bill Vote Approaches Roll Call

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget